The Tax Clearance Letter is a letter issued by the Inland Revenue Board IRB to notify the employer of a deceased retiringresigning employees tax liability to enable the employer to make the final payment of salarycompensationgratuity to the employee. It is in your best interest to pay as quickly as possible to minimize penalties and interest.

Home Payroll Guide to complete Form CP22A Pemberitahuan Pemberhentian Kerja Swasta January 22 2016 Lay Mei Yap Payroll No Comments.

. Find out how HM Courts and Tribunals Service uses personal information you give when you fill in a form. The IRS asks that you pay the balance due in full. Form CP22B Tax Clearance Form for Cessation of Employment of Public Sector Employees.

If the value of the content is over 270 you must use a CN23 form. IRS letter CP22A considered a tax bill. An employer is not required to give notice of cessation of the employment in the following instances-.

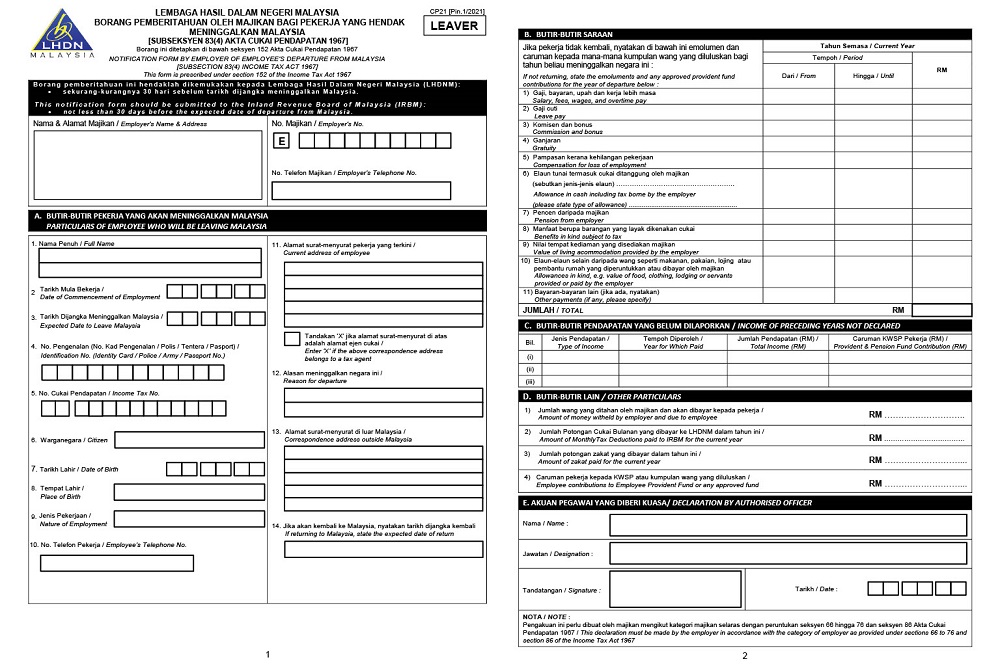

2 mens cotton shirts. SUBSEKSYEN 833 AKTA CUKAI PENDAPATAN 1967 CP22A Pin. The Economic Operator Registration and Identification scheme guide will give you information on how to apply for an Economic Operator Registration and Identification number.

Criteria on Incomplete Form CP21 CP22 CP22A and CP22B Which is Unacceptable. Relief From Stamp Duty. Tax Clearance Form CP21 CP22A CP22B.

3 Applicants phone numbermobile number Email address 4 Type of customs activity you are involved in For example importer exporter etc. In addition to the Notice CP22 you will also receive a Publication 5219 which barely explains a. Amendments To The Stamps Act 1949.

CP22A Notice date January 30 2019 Social security number nnn-nn-nnnn Make your check or money order payable to the United States Treasury. 1 Give a detailed description quantity and unit of measurement for each article eg. To accelerate customs clearance fill in this form in English French or in a language accepted by the destination country.

The Notice CP22A is typically used for changes in filing status or dependency exemptions while Notice CP22I notifies you of changes to your IRA taxes. For columns highlighted below please fill in based on own record. Y cp22a-pin 105 notification of cessation of employment persuant to subsection 833 income tax act 1967 this form must be sent to the nearest office of lembaga hasil dalam negeri malaysia.

IRBM Stamp Duty Counter. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax. CP21 FOREIGN LEAVER Application.

Form CP22A Tax Clearance Form for Cessation of Employment of Private Sector Employees. Enter the taxation year for which the CP22A Form needs to be printed in Year of CP22A Tax Assessment. To be completed by all applicants 1 Applicants full name Applicants trading name 2 Applicants address including postcode.

12015 Tandakan X jika alamat surat-menyurat di atas adalah alamat ejen cukai E E Pilihan. LEMBAGA HASIL DALAM NEGERI MALAYSIA CP22A Pin12021 BORANG PEMBERITAHUAN PEMBERHENTIAN KERJA SWASTA SUBSEKSYEN 833 AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 Tandakan X jika alamat surat-menyurat di atas adalah alamat ejen cukai E E Pilihan 1. The CP22A Tax Malaysia entry screen appears.

You do have options to setup arrangements with the IRS if you are unable to pay the balance due in full. You might find out some columns are empty when you preview the Borang CP22A from Payroll system. You must give the senders full name and address on the front of the item.

BUTIR-BUTIR SARAAN Butir-butir saraan yang diterima dalam tahun semasa untuk tempoh dari hari pertama tahun semasa sehingga tarikh berhenti kerja bersara meninggal dunia Tahun Semasa Tempoh. Please read the notes on page 5 before completing this form. Responsibility of Company Secretary Registrar.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips taxable scholarships or fellowship grants and unemployment compensation. Notice CP22A Tax year 2016 Notice date January 30 2019 Social security number. Published 1 January 2016 Last updated 21.

Use form C220A to. You can enter the Present Address and Future Address. 5 Legal status entity of the applicant Enter.

Besides the standard selection section of the entry screen the following additional parameters need to be addressed. For Tax Clearence Letter purposes. The regulation in full.

Notifications made pursuant to regulations 14 to 18 and 21 and 22 must be made using the forms provided by the Commission for this purpose. Stamp Duty Exemption Order. Write your social security number nnn -nn nnnn the tax year 2016 and the form number 1040 on your payment.

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Update To The Irs S 21k Mistake Bill Got Through To Them The Rep Agreed I Sent An Official Letter And The Response Shows No Evidence That They Even Looked At It What

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Download Your Personal Tax Clearance Letter Cp22 Cp22a

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Not Sure How To Reply To This Cp2000 R Tax

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Tp1 Form Tp2 Form Tp3 Form Malaysia Free Download Sql Payroll Hq

The Proper Use Of The Forward Slash In English Esl Grammar Explanatory Writing Grammar Writing Poetry

Irs Tax Notices Explained Landmark Tax Group